Data Via 2014 General Aviation Statistical Databook & 2015 Industry Outlook, General Aviation Manufacturers Association

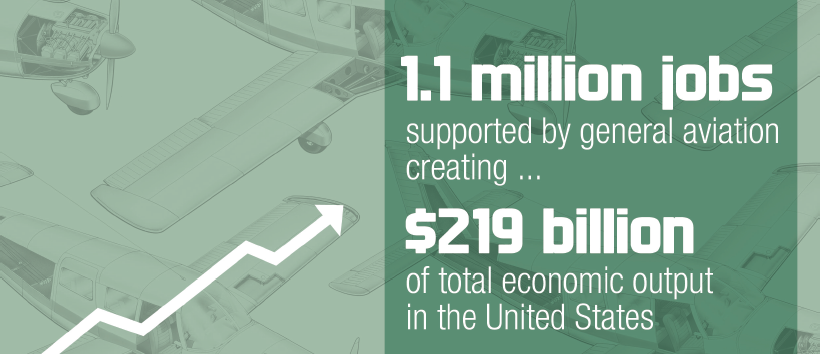

Eight general aviation associations published a new industry-wide study detailing the economic contributions of general aviation to the U.S. economy. The study, conducted by PricewaterhouseCoopers, determined that general aviation supports 1.1 million total jobs and supplies $219 billion in total economic output in the United States. These numbers include direct, indirect, induced and enabled impacts.

The General Aviation Manufacturers Association (GAMA), Aircraft Electronics Association (AEA), Aircraft Owners and Pilots Association (AOPA), Experimental Aircraft Association (EAA), Helicopter Association International (HAI), National Association of State Aviation Officials (NASAO), National Air Transportation Association (NATA) and National Business Aviation Association (NBAA) funded the study, which determined the industry’s economic impact based on data from 2013, the most recent year available.

Joe Brown, President of Hartzell and Chairman of GAMA, announced the findings to a packed house at the Newseum in Washington, D.C. GAMA President and CEO Pete Bunce summarized the report’s findings for the crowd.

“This important new study confirms our industry’s strength and resilience. It clearly shows that general aviation positively affects economies and communities in all 50 U.S. states,” Bunce said. “Our industry-wide workforce provides the lift for our wings and rotors, and these high-quality, good-paying jobs have a tremendous impact on the U.S. economy.”

The study was released as part of GAMA’s annual “State of the Industry” press conference, which recaps industry performance in the past year. The organization reported that total worldwide general aviation (GA) airplane shipments rose 4.3 percent, from 2,353 units in 2013 to 2,454 units in 2014.

Shipments of piston-engine airplanes were positive, rising 9.6 percent in 2014. Business jet shipments also rose 722 units, an increase of 6.5 percent from the 678 business jets shipped in 2013. Turboprop shipments declined, however, by 6.5 percent to 603 units. Rotorcraft shipments slowed for both piston and turbine aircraft compared to the previous year. A total of 230 rotorcraft and 778 turbine rotorcraft were shipped in 2014, which is a 31.3 percent and a 20.3 percent reduction, respectively, from the strong deliveries posted in 2013.

“The mixed results among segments indicate that the general aviation manufacturing industry is still facing headwinds given the tepid U.S. economic recovery and the political and economic uncertainties in Europe,” Bunce said.